Capture of leads and data updated in real time.

At your fingertips the possibility of capture leads and generate New customers more than 400 verified data through our automatic processes information capture and smart forms.

A platform to detect sales opportunities, improve policies and achieve comprehensive clients.

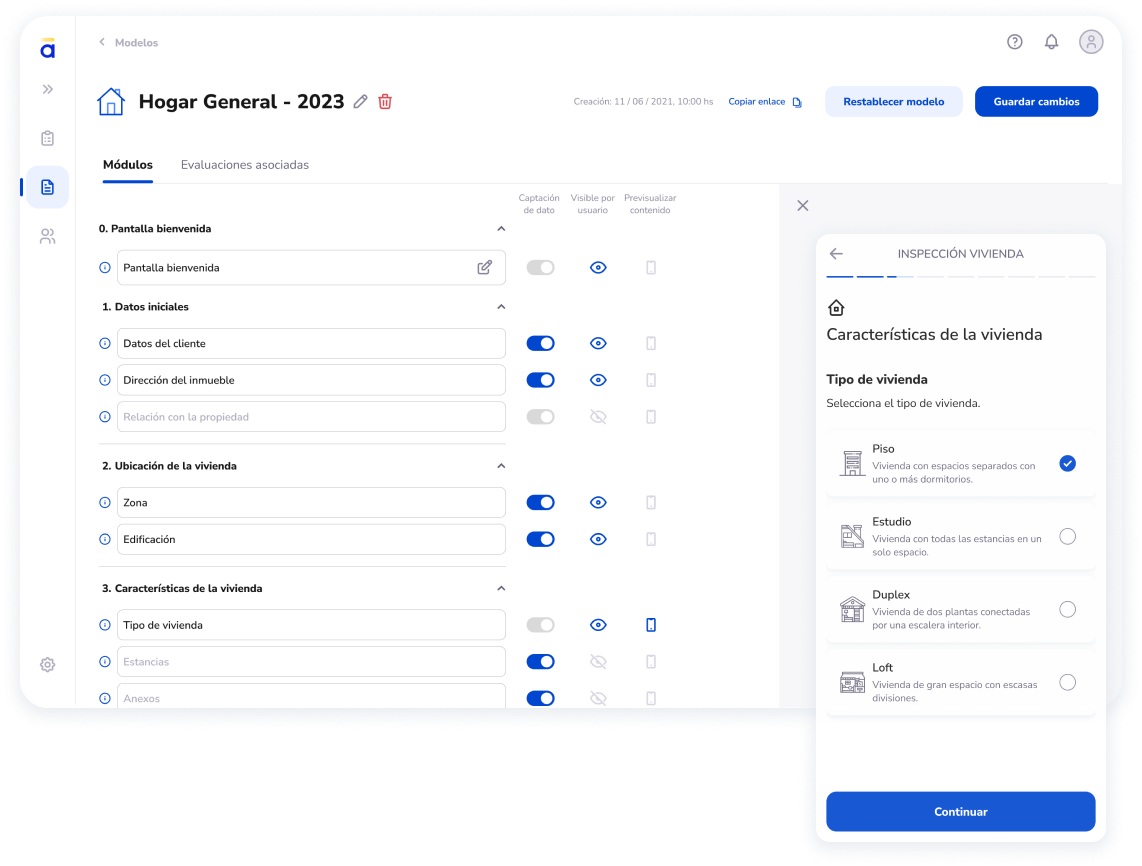

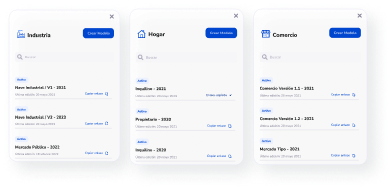

How does the generation of forms to capture leads work?

We create value and impact in the insurance sector through intelligent data solutions.

We provide more than 400 reliable data about a risk and its environment, thus helping to improve pricing, renewal, analysis and portfolio maintenance processes, as well as capturing new leads through our intelligent forms. We have three ways to obtain the data.

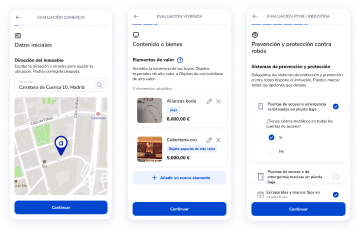

Home

Business

Industry

Community

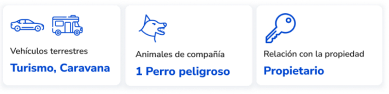

Vehicle

Life

and many more…

aira use cases

Learn all the ways you can use our platform to boost your business.

Online lead capture

Fine and instant pricing.

Fine knowledge of fraud risks and prevention.

Portfolio analysis and maintenance.

Claim declaration and timely and automatic analysis of the policy.

Success stories

allows you to delve deeper into your clients' needs.

Book a demo

More than 30 clients have already tried aira, connecting with more than 200 policyholders, and you? Do you want a free demo?

A platform to control everything

DASHBOARD

CUSTOMIZABLE

RISKS

PORTFOLIO

ALERTS

USER. EXP

Relocate your sales

Absolute control of the data

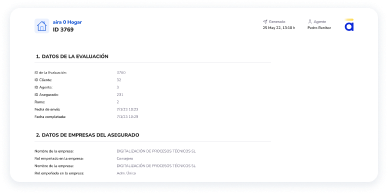

Work with a panel where you can manage your recruitment forms, the different products and those policies close to expiration. All the information you need centralized to help you make better decisions.

Create your own models

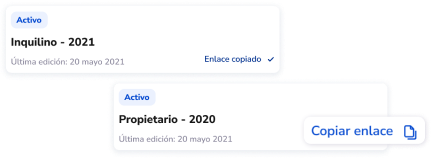

Create different smart forms to use on your website, your social networks or WhatsApp and to send them to clients at any time. From your office, you can sell anywhere in Spain.

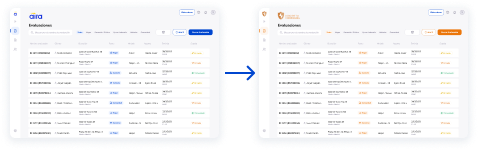

Change the look of the panel

Customize the panel to your liking with a logo and a different color range so that you and your clients feel at home. The dashboard configuration allows you to interact with your customers while maintaining your own corporate brand.

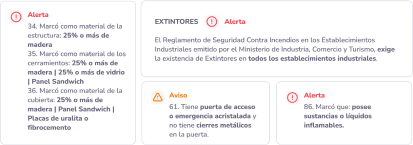

Receive complex alerts and notices

We offer more than 4,000 possible configurations and, of course, technical assistance to define the types of alerts and notices you want to receive with each form received. The dynamic configuration of forms allows each client to configure their own needs and receive notifications of the most important points.

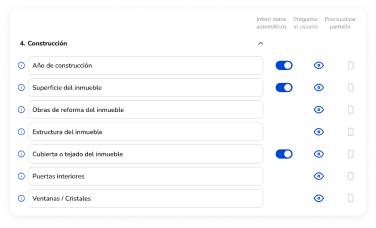

Maximum detail

Configure what you want to ask, what should alert you and how you want to receive the information, it couldn't be easier.

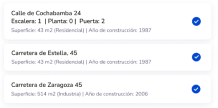

Total control of your portfolio and clients

You will have an analysis, not only of your client's risk, but an infinite amount of data to cross-sell products. Not to be a doomsayer, but if your client practices risky sports, it's better to do so with life insurance, don't you think?

Policies always updated

When the policies expire, you just have to automate the submission of the aira 1 form with the data to update or generate an aira 0 yourself and update the data instantly. Policies always updated. We make it easy for you.

Direct and agile connection with the client

Send data collection forms with a single click. As simple as sending an SMS with the link and, from your mobile phone or computer, they will provide you with the information. You can also send the links by WhatsApp, email and any other means.

One click away

Your client will be able to attach all the necessary information without you leaving the office, all via the web - on mobile and PC -, a significant cost savings.

How can we help you?

Contact the founders or the sales team

Do you want to invest or learn more about the company?